How HNDL Offers a 7% Distribution Through True Diversification

We sat down with David Cohen and Matthew Patterson of HANDLS Indexes and David Miller of Strategy Shares ETFs to discuss the Strategy Shares Nasdaq 7HANDL Index ETF (Nasdaq: HNDL), which aims to provide a 7% monthly distribution to investors through a diversified blend of fixed income and equities. Learn more about the benefits of investing in HNDL below:

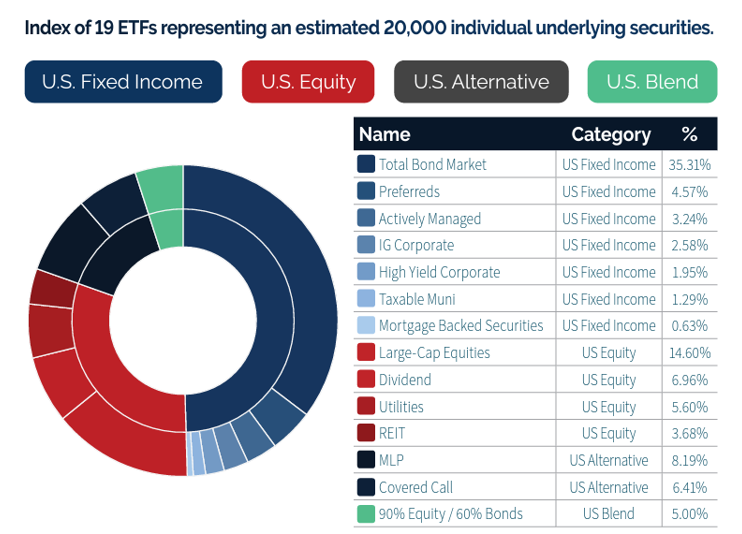

- HDNL is split into two components – a 50% allocation to fixed income and equity ETFs, which you refer to as the Core Portfolio, and a 50% allocation to a Dorsey Wright Explore Portfolio – which is a more tactical allocation with U.S. fixed income, blend, equity, and alternative assets that have historically provided high levels of income. How did you develop this approach and what is the investment thesis behind its success?

When we launched HNDL, interest rates were at rock bottom levels and investors struggling to find yield often went to closed-end funds. Our approach here is to replicate what a closed-end fund does in terms of providing diversified equity and fixed income exposure coupled with a managed distribution while avoiding the downsides of closed-end funds.

The bottom line is the market price of a closed-end fund fluctuates around the NAV on a regular basis and that such price movements create premium-discount volatility that provides no corresponding return. It’s risk without reward. We created HNDL with the objective of providing the benefits offered by closed-end funds while eliminating the premium-discount volatility that provides no additional return.

HNDL is also considerably less expensive than closed-end funds. All-in expense ratios of closed end funds can be over 200 bps. For us, we’re still below 100 bps. Obviously, we’ve been challenged because the bond market had a rough 2022 and we have a 70/30 fixed income/equity core allocation, but as we’ll explain, the current investment environment is attractive.

HNDL Characteristics as of Sept. 30, 2023

- The Fund has historically delivered a monthly distribution of 7% – given this, which types of investors do you think can benefit most from an investment in HNDL?

We see two types of people in the investment world: those in accumulation mode who are saving money on a month-to-month basis, and those in the decumulation phase of their investment lives, during which people draw down their savings to spend in retirement. The reality is very few people have enough money to live off just interest and dividends alone.

We’ve said from the beginning that investors need options to decumulate their assets in a tax-efficient manner. They can sell individual securities and deal with tax implications, or with HNDL, we’ll put it in a nice package, easy to understand, and pay a 7% managed distribution.

The portfolio re-allocates every month; it’s like an automated, efficient stream of income. So, any investors that are looking for a tax-efficient way to generate an automated 7% distribution could benefit from HNDL.

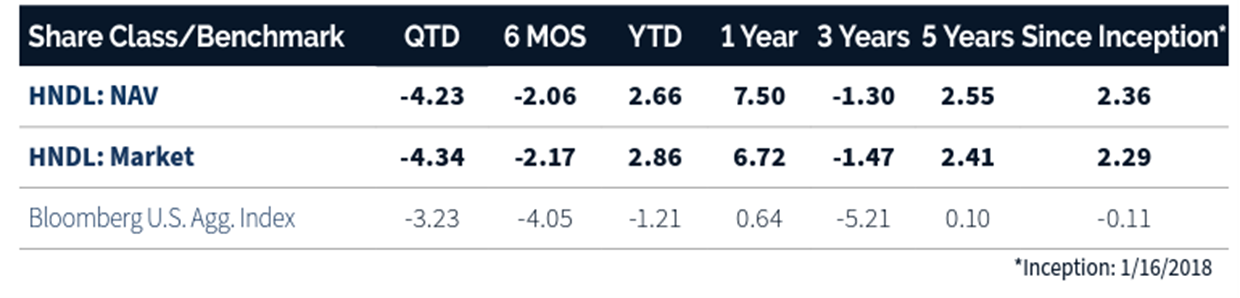

- Looking at the Fund’s performance, it has outperformed the Agg thus far in 2023, over the past year, and over 3 years, 5 years, and since the product’s inception in 2018. What has been the key to outperformance?

Investors have been shifting to bonds, and we view HNDL as a “Bond Plus” type of investment. But the biggest factor in our outperformance is our equity beta category. We have a 30% equity allocation in the Core Portfolio, and half of that is in QQQ’s. That category has outperformed the S&P 500 by large margins – in part due to our QQQ exposure.

The simple answer as to what has driven our success is diversification. Over the short term, you may see more volatility in HNDL than you would holding purely bonds, but diversification is the only free lunch in investing. This approach reflects the fundamental insight of modern portfolio theory: investors can earn higher risk-adjusted returns by investing in diversified portfolios.

The behavioral aspects of investing can also be difficult, but our systematic approach helps us be consistent and maintain a targeted level of risk appropriate for income-oriented investors.

HNDL Performance (%) Ending September 30, 2023

Annualized if greater than a year

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-HSS-ETFS or visiting strategysharesetfs.com. Market returns are based on the composite closing price and do not represent the returns you would receive if you traded the shares at other times. The first trading date is typically several days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the first trade date.

- Given interest rates seem to be leveling off as the Fed seemingly winds down its fight to combat inflation, albeit at a level much higher than we saw years ago, how does this current market environment impact fund performance? When are the best times to invest in HNDL?

The headline right now is you can pick up 5.5% yield on 30-day treasuries – that’s a tough hurdle for a risk product to beat. But that’s not forever. Once we enter a rate cutting environment, those attractive short-term rates will go away. At the long end of the curve, we’re now in a position where we’re collecting 5% interest and seeing a lot less pressure on equity allocations to meet our distribution target. As rates go lower, you’re going to see capital appreciation on the fixed-income side.

We’re more bullish on the strategy than we’ve ever been. If you’re already earning more than 5% in interest income on the fixed income side, it’ll be a lot easier to meet that 7% hurdle moving forward.

We don’t think we’ve seen a better income investing environment in 20 years outside of maybe 2007. We’re constantly seeing signs that the world is weakening. Personally, we’d rather have a balanced portfolio that takes advantage of the attractive interest rates we’re seeing across the yield curve. If you’re an income investor and you’re looking to deliver an income stream over the next decade, right now is a great time to be in HNDL. You’ve got 70% in bonds delivering solid yields and an equity kicker on top of it.

- Investors have plenty of options when it comes to ETFs – what makes HNDL unique?

The most attractive part about HNDL, in our opinion, is the consistency of the approach and the fact that it’s built on the foundation of everything widely accepted in finance – in short, the diversification basket always wins in the long run. This is a unique product designed to deliver an efficient monthly cash distribution on a tax-efficient basis.

We built this strategy based on modern portfolio theory. We truly believe investors are going to earn better risk-adjusted returns in the long run if they invest in diversified portfolios. We can all debate what the optimal portfolio is, but we’ve spent time researching and believe we have an attractive product for investors.

There are 10,000 baby boomers retiring every single day and they need options. Yes, they can look to annuities, but then they lose control of their money and there are a lot of fees baked in. HNDL packages everything together for the investor and provides a monthly income check higher than a 4% distribution solution.

Risk Considerations:

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Nasdaq 7HANDL Index ETF. This and other important information about the Fund is contained in the full or summary prospectus, which can be obtained by calling (855) HSS-ETFS (855-477-3837) or at www.strategysharesetfs.com. The Strategy Shares are distributed by Foreside Fund Services, LLC, which is not affiliated with Rational Advisors, Inc., or any of its affiliates.

Investment in a fund of funds is subject to the risks and expenses of the underlying funds. Diversification and asset allocation may not protect against market risk or loss of principal. Certain sectors and markets perform exceptionally well based on current market conditions and the Nasdaq 7HANDL ETF can benefit from that performance. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. The use of leverage can amplify the effects of market volatility on the fund’s share price and make the fund’s returns more volatile. The use of leverage may cause the fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The use of leverage may also cause the fund to have higher expenses than those of funds that do not use such techniques.

HANDLS™ and HANDL™ are trademarks of Bryant Avenue Ventures LLC and have been licensed for use by Rational Advisors, Inc. Shareholders should not assume that the source of a distribution from the Fund is net profit. Shareholders should note that return of capital will reduce.