THE ERODING DOLLAR: WHY ADVISORS NEED A NEW PLAYBOOK FOR CLIENT PORTFOLIOS

How to Defend Client Portfolios in an Age of Dollar Devaluation

Updated November 2025 by Rational Advisors, Inc.

Updated November 2025 by Rational Advisors, Inc.

For decades, financial advisors have told clients that careful diversification, patience, and discipline are keys to retiring securely. Money once meant safety. Bonds once meant income stability – the foundation of retirement income. Today, that bedrock is cracking under the weight of inflation and a dollar in decline. A primary source of retirement income – bond portfolios – have generated negative returns after inflation over the past decade. No wonder many clients don’t feel better off. The problem is that almost every investment plan begins with the same assumption: the U.S. dollar, the world’s reserve currency, holds its worth.

Nominal returns disguise real losses once inflation is accounted for.

1 Bloomberg LP. Bond portfolios represented by the Bloomberg U.S. Aggregate Bond TR Index, which is a broad-based fixed income index that represents the overall performance of the U.S. investment grade bond market, including U.S. Treasurys, corporate bonds, mortgage-backed securities, and asset-backed securities (excluding high yield or “junk” bonds). Cumulative Inflation represented by the Consumer Price Index, which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Data from 09/30/15 to 09/30/25. September 2025 CPI based on Bloomberg survey of economists.

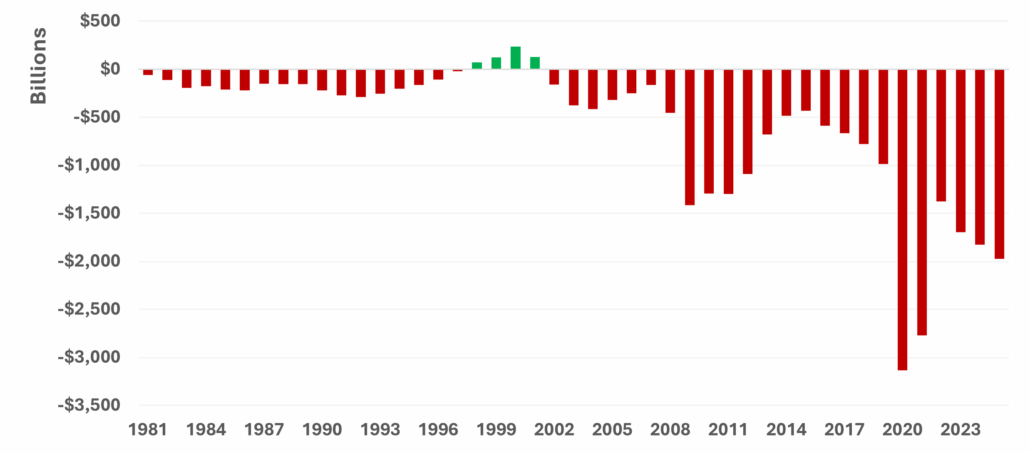

Deficits aren’t new, but trillion-dollar shortfalls are now an annual occurrence, driving a debt trajectory without precedent. For advisors, this isn’t abstract policy, it’s the silent force undermining every client’s real return.

Trillion-dollar shortfalls have become a seemingly permanent feature of fiscal policy.

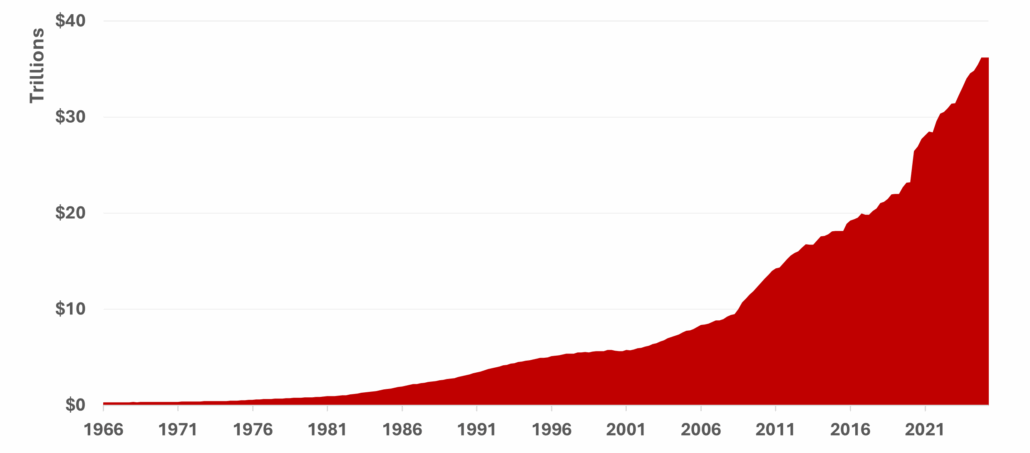

Growth in the national debt now exceeds the nation’s productive capacity

2U.S. federal deficit or surplus. U.S. Department of Treasury. Federal Reserve Economic Data. Based on monthly data through September 2025.

3Department of Treasury. Debt held by the public. Based on quarterly data through April 2025.

Why are financial advisors finding a disconnect between market performance and client experience? Grocery bills are up +20%4, and “safe” instruments like CDs are paying far less than that. Even traditional investments, like bonds, are down after inflation. Clients can feel the math – and they’re right. The dollar simply buys less.

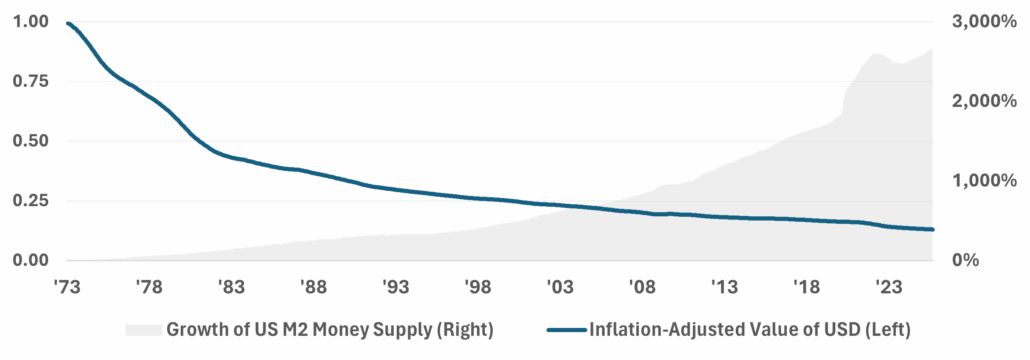

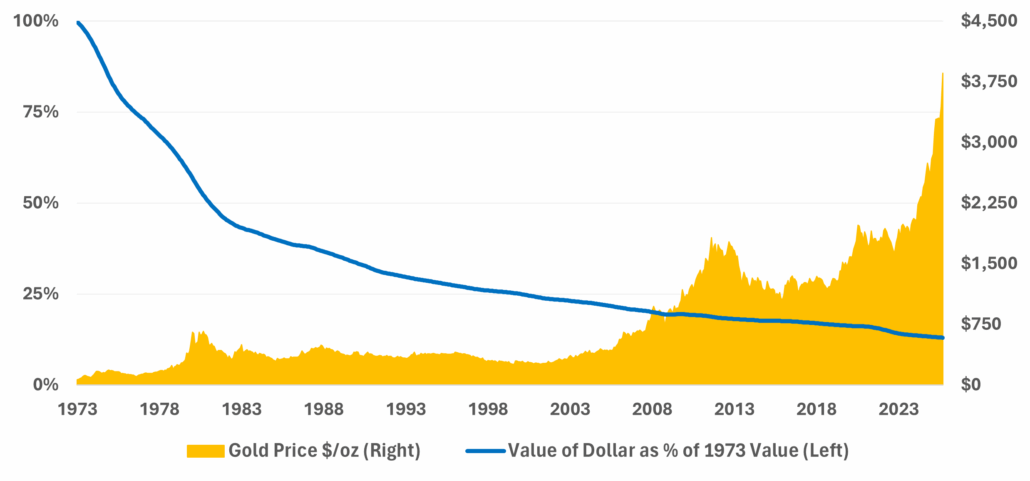

The purchasing power of the dollar is declining. The long-term chart of the dollar’s purchasing power dating back to 1973 shows a significant decline. What once bought a cart of groceries in 1973 could barely buy a bag of groceries today. A dollar is worth just 13 cents of what it used to be.

Decades of excessive spending by the federal government and easy monetary policy by the Federal Reserve have flooded the economy with dollars faster than it can produce goods and services, diluting purchasing power and feeding inflation.

How do you service $1 trillion in debt when there’s no fiscal room left? Simple, you print more money and continue to devalue the dollar. Inflation has already erased a decade of real bond returns. Fiscal devaluation isn’t a failure, it’s the plan.

When policy rewards spending over saving, the dollar itself becomes the casualty.

A system built to spend money, not save.

The money supply has risen nearly 200% since 2008. A growing supply of dollars chases the same goods: the recipe for inflation.5

4Source: U.S. Bureau of Labor Statistics. Data for 2025 compared to 2020.

5M2 money supply is a measure of money circulation that includes total dollars in cash deposits and other deposits readily convertible to cash, such as money market funds.

6Bloomberg LP. Board of Governors of the Federal Reserve. OECD. September 2025.

7U.S. Department of Treasury. September 2025.

When spending outpaces revenue this dramatically, inflation becomes policy.

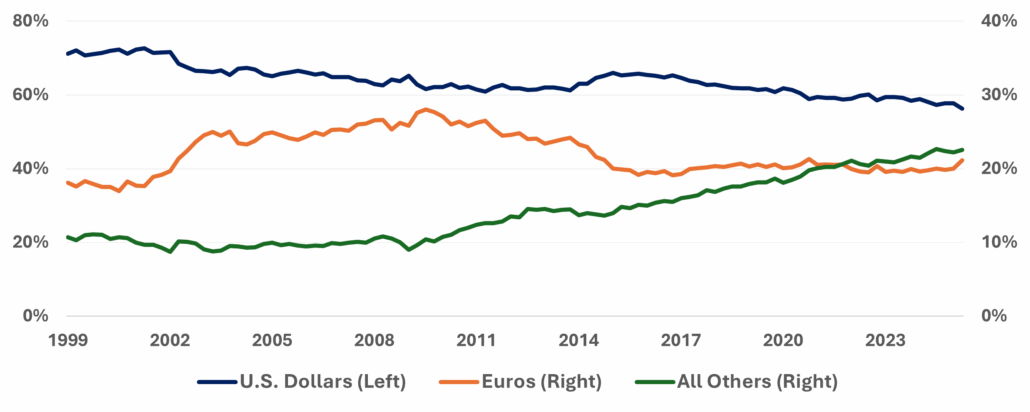

What Washington treats as a domestic problem, the rest of the world now treats as a risk to avoid. The rest of the world is acting on what Washington refuses to admit. Amid rising U.S. debt and persistent geopolitical tensions, central banks have quietly reduced their U.S. dollar exposure, putting further downward pressure on the dollar’s value. For the first time in a generation, global reserve managers are voting with their reserves, and not with the dollar.

The dollar’s share of global reserves has fallen from 71% in 1999 to 56% today.

8U.S. Department of Treasury. September 2025.

9Bloomberg LP. IMF COFER. June 2025.

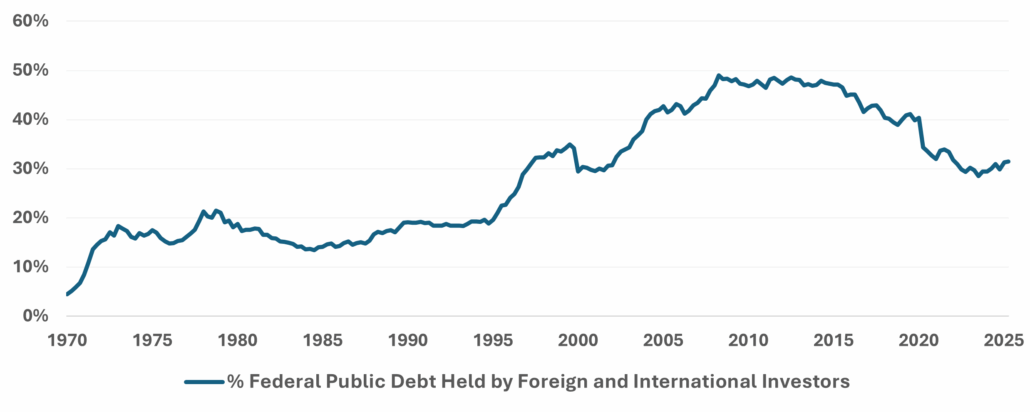

Foreign ownership of U.S. debt has dropped from nearly 50% to just over 30% since 2008.

In the 1970s, gold soared as the dollar broke from its anchor.11 Today, central banks are restoring that anchor, not for nostalgia, but necessity. Nations around the world are making record purchases of gold. It’s driven by math as much as by geopolitics. Nations are essentially hedging against policy failure.

The world’s monetary authorities are trading paper promises for a tangible store of value in gold.

10U.S. Department of Treasury. April 2025.

11Prior to 1971, the U.S. dollar was backed, at least in part, by gold reserves (commonly referred to as the “gold standard”). In 1971, the U.S. switched to a fiat monetary system, effectively ending the “gold standard.” Fiat money has no value of its own and is not backed by gold; rather, its value is derived from the trust and stability of the government that issues it.

12Bloomberg LP. Quarterly demand (net purchase) data. September 2025.

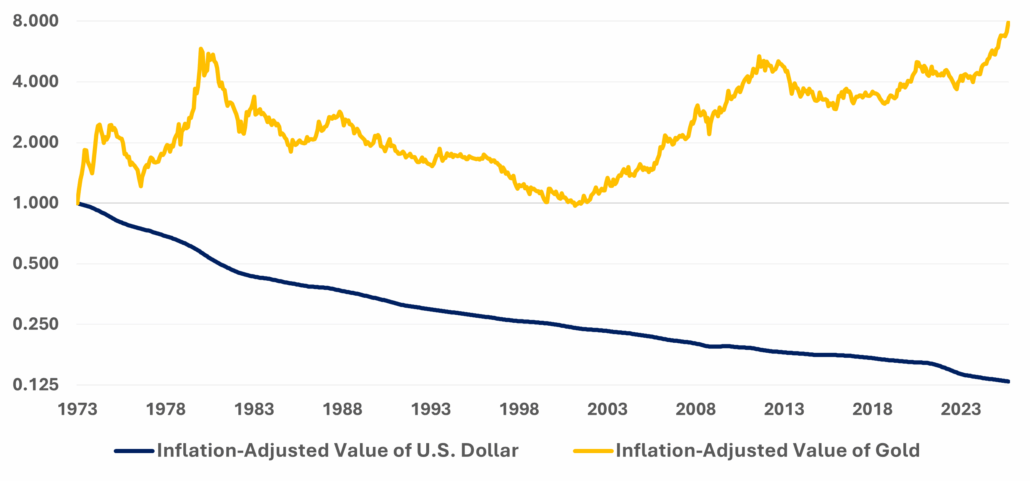

The desire for gold should come as no surprise. When looking at a chart since 1973 – the decade the dollar and gold parted ways – the value of gold has increased more than 60x (and almost 8x when adjusting for inflation).

Half a century of data confirms gold’s role as a long-term store of value against monetary decay.

Gold has delivered positive real returns across decades of shifting policy regimes.

Since 1973, gold has generally outpaced inflation. Its purchasing power has endured while fiat currencies have come and gone. Now, even the world’s largest central banks are accumulating gold again.

13Bloomberg LP. Board of Governors of the Federal Reserve. OECD. September 2025.

14Bloomberg LP. OECD. September 2025.

The U.S. government can’t cut spending without risking a collapse in confidence. So, it will likely take the easier road and let inflation do the work, whether it be official policy or not. The result will be that every dollar will buy a little less each year; not a typical immediate crisis, but rather a long-term process. Those who wait may be too late.

The role of the advisor isn’t to calm the storm; it’s to build an ark and make sure it floats as the flood of dollar devaluation continues to rise. It is difficult for clients to diversify away from Washington’s fiscal math, but they can own something that isn’t bound by it. An allocation to gold can be a fundamental part of the ark.

By positioning clients in gold, financial advisors offer the potential to defend purchasing power. Making modest allocations to gold isn’t about timing markets; rather, it’s about anchoring wealth to something real. Real wealth is measured by what endures when paper promises don’t, not necessarily just what your account statement tells you.

In a world where yield alone can’t buy stability, gold restores value-driven discipline to the modern income portfolio, offering the potential to protect purchasing power when it’s under the greatest attack. By combining gold with income producing assets, investors may be able to hedge their income against inflation. This design seeks to avoid the decline in purchasing power that continues to burden many.

Those who treat gold as a mere “trade” risk will miss its purpose; those who treat it as value-driven discipline are typically better able to preserve real wealth over time.

This communication is provided for informational purposes only. Rational Advisors, Inc., the investment advisor to several Strategy Shares ETFs, offers financial products that may be discussed in this communication. Rational Advisors, Inc. has used resources that it believes to be reliable, including certain market and price data and related statistical information, to prepare this communication; however, Rational Advisors, Inc. does not guarantee its completeness or accuracy. This communication is not intended as an offer or solicitation for purchase or sale of any financial product. This communication should not be construed as investment advice.

Risk Considerations:

Investments involve risk, including possible loss of principal. Past performance is not a guarantee of future results. Investors should carefully consider the investment objectives, risks, charges and expenses of the Strategy Shares ETFs. This and other important information about the ETFs is contained in the full or summary prospectus, which can be obtained by calling (855) HSS-ETFS (855-477-3837) or at www. strategysharesetfs.com. The Strategy Shares are distributed by Foreside Fund Services, LLC, which is not affiliated with Rational Advisors, Inc., or any of its affiliates.

The price of gold fluctuates over time. There is no guarantee that an investment in gold will increase or even maintain its value. Short-term, the price of gold has fluctuated widely. If gold markets continue to be characterized by wide fluctuations, the price may change in an unpredictable manner. Long-term, gold markets have historically experienced extended periods of flat or declining prices. There is no guarantee that the price of gold will move as expected relative to the U.S. dollar, nor is there any guarantee that gold will act as an effective inflation hedge.

Some of the statements in this communication may contain or be based on forward looking statements, forecasts, estimates, projections, targets or prognoses (collectively, “forward-looking statements”), which reflect the Adviser’s current view of future events, economic developments and financial performance. Such forward looking statements are typically indicated by the use of words which express an estimate, expectation, belief, target or forecast. Such forward-looking statements are based on an assessment of historical economic data, on the experience and current plans of the Adviser and/or certain of its advisors and/or affiliates, and on the indicated sources. These forward-looking statements contain no representation or warranty of whatever kind that such future events will occur or that they will occur as described herein, or that such results will be achieved by any investment vehicle or the investments of any investment vehicle, as the occurrence of these events and the results of the investment vehicle are subject to various risks and uncertainties. The actual portfolio, and thus results, of any investment vehicle may differ substantially from those assumed in the forward-looking statements. The opinions expressed reflect the best judgment of the Adviser at the time this letter was drafted, and the Adviser and its affiliates will not undertake to update or review the forward-looking statements contained in this presentation, whether as a result of new information or any future event or otherwise.