Is This the End of the Dollar as the World’s Reserve Currency?

Why we believe gold is best positioned to replace the dollar as the reserve hard currency at major central banks.

Published November 2024 by Rational Advisors, Inc.

Published November 2024 by Rational Advisors, Inc.

According to Milton Friedman, there are four ways to spend money: spending your money on yourself, spending your money on someone else, spending someone else’s money on yourself, and spending someone else’s money on someone else. Why is this important? Because this construct helps explain how we went from the U.S. dollar securely holding the position of the world’s reserve currency to where it seems to be a matter of when, and not if, it will lose that status.

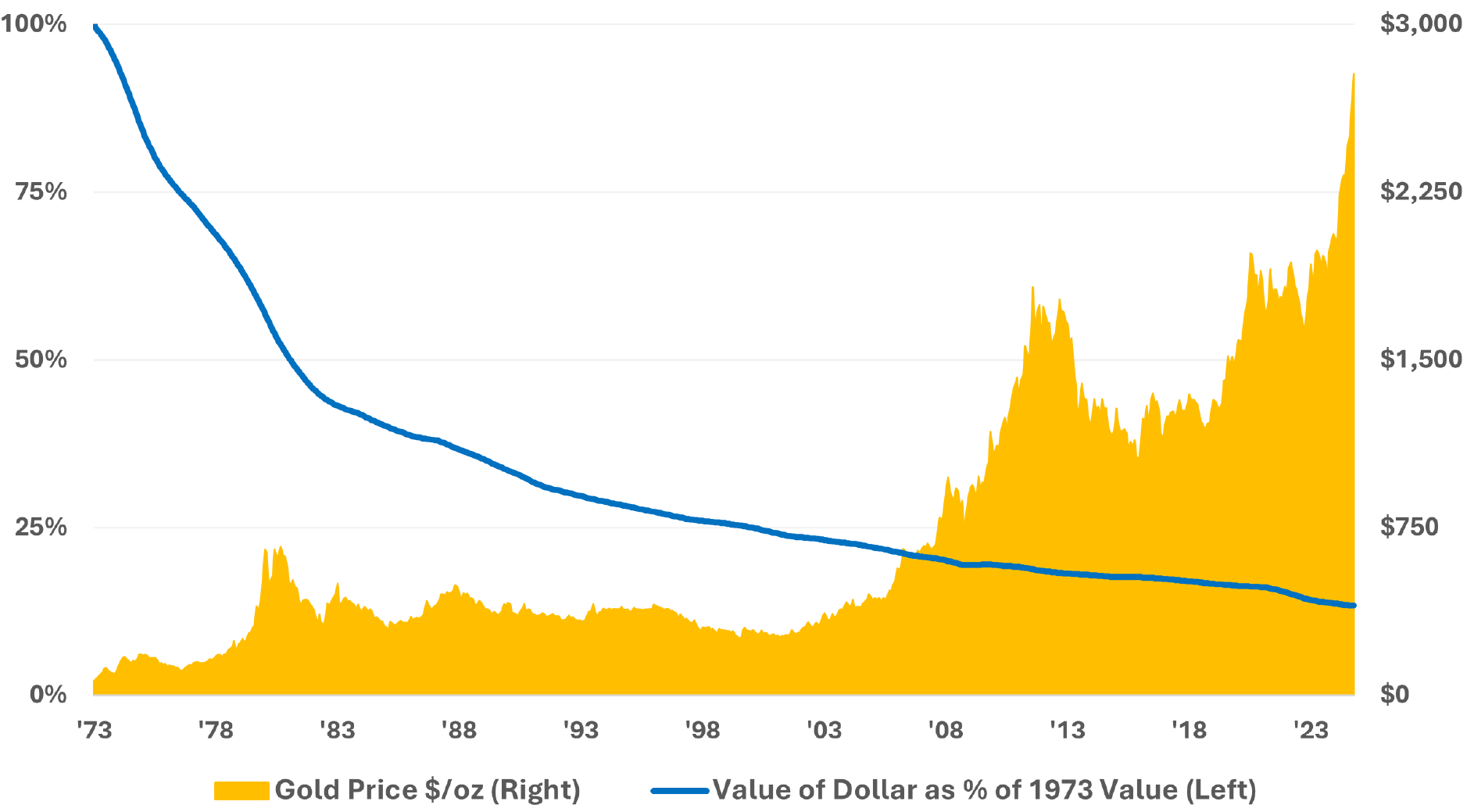

Prior to the 1970’s, the U.S. government historically operated with some degree of fiscal responsibility, partially because of the requirements under the Bretton Woods System (“BWS”) where the dollar was fixed to the price of gold. BWS dissolved between 1968 and 1973, and, by 1973, all major currencies began to float against each other1. In this free-floating system, the USD retained its status as the world’s reserve currency, leveraging the historical standard it had under BWS in the post-war era.

In the absence of fiscal constraints, like pegging the dollar to gold, it became clear that the U.S. government was spending someone else’s money — with little care and by printing as much as it could without risking the reserve currency status. As the years went on, the debt-financed deficits became more extreme and increasingly politically motivated. No end is in sight. De-dollarization has already started and is likely to continue.

In this environment, it comes as no surprise that gold continues to make headlines, whether from large central bank purchases, to record prices, to individuals buying up all the gold bars that Costco can stock. Gold is uniquely positioned to retain its value even in the face of extreme fiscal irresponsibility. In this white paper, we make the argument for why investors should hold gold and why gold is well positioned to replace the U.S. dollar as the world’s hard reserve currency.

1International Monetary Fund. The end of the Bretton Woods System (1972-81).

2Bloomberg LP. Board of Governors of the Federal Reserve. OECD. September 2024.

To understand the driving factors behind the decline in the value of the dollar and the surge in the price of gold, one of the best places to start is by reviewing the fiscal policy of the U.S. government

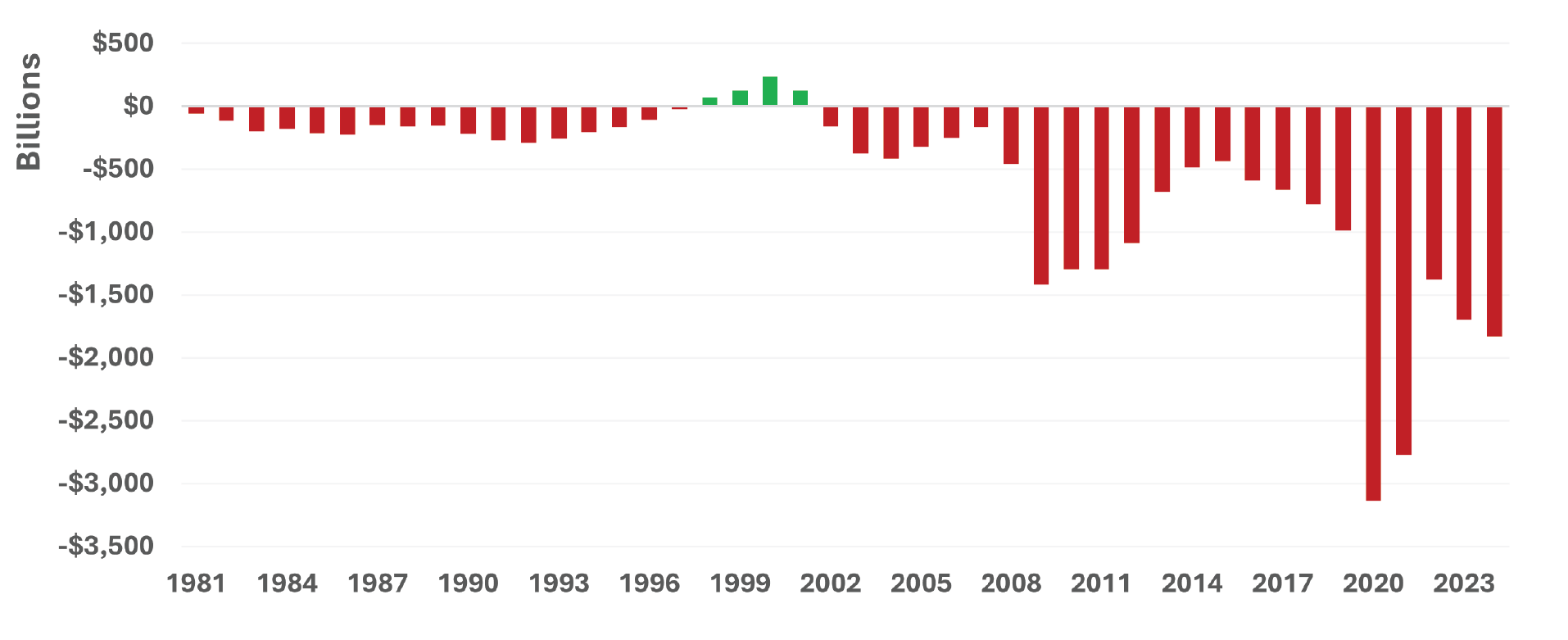

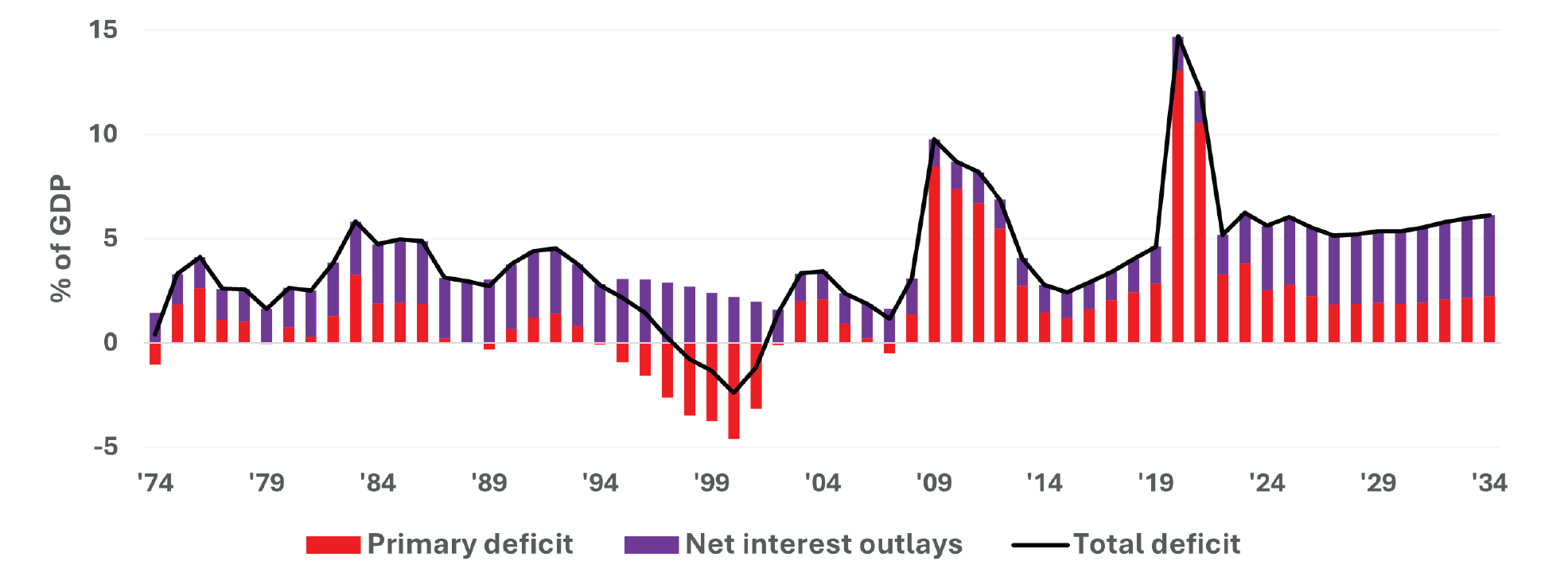

Following the end of BWS, the U.S. federal government was able to run a deficit with limited consequences. This accelerated over time to astronomical levels of spending following the great financial crisis in 2008.

3U.S. Department of Treasury. September 2024.

4U.S. federal deficit or surplus. U.S. Department of Treasury. Federal Reserve Economic Data. Based on monthly data through September 2024.

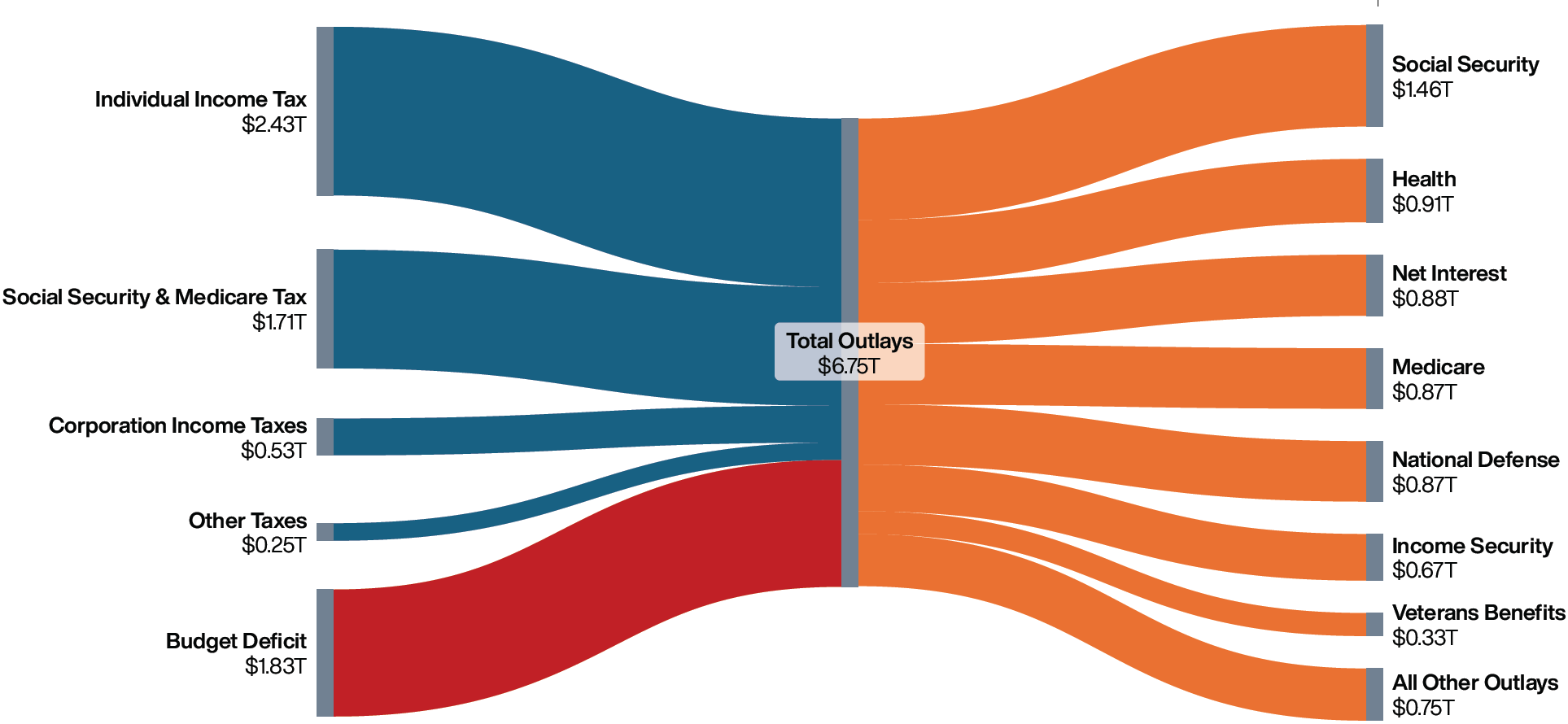

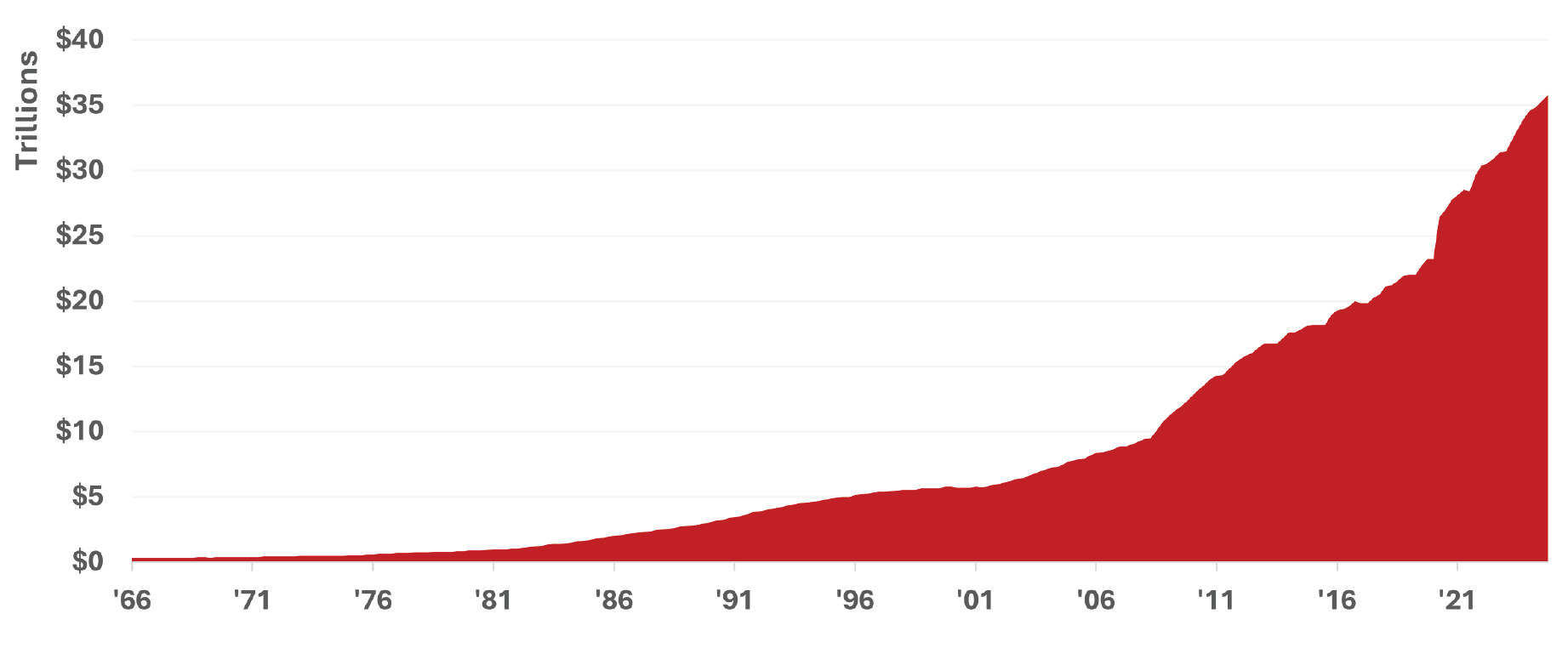

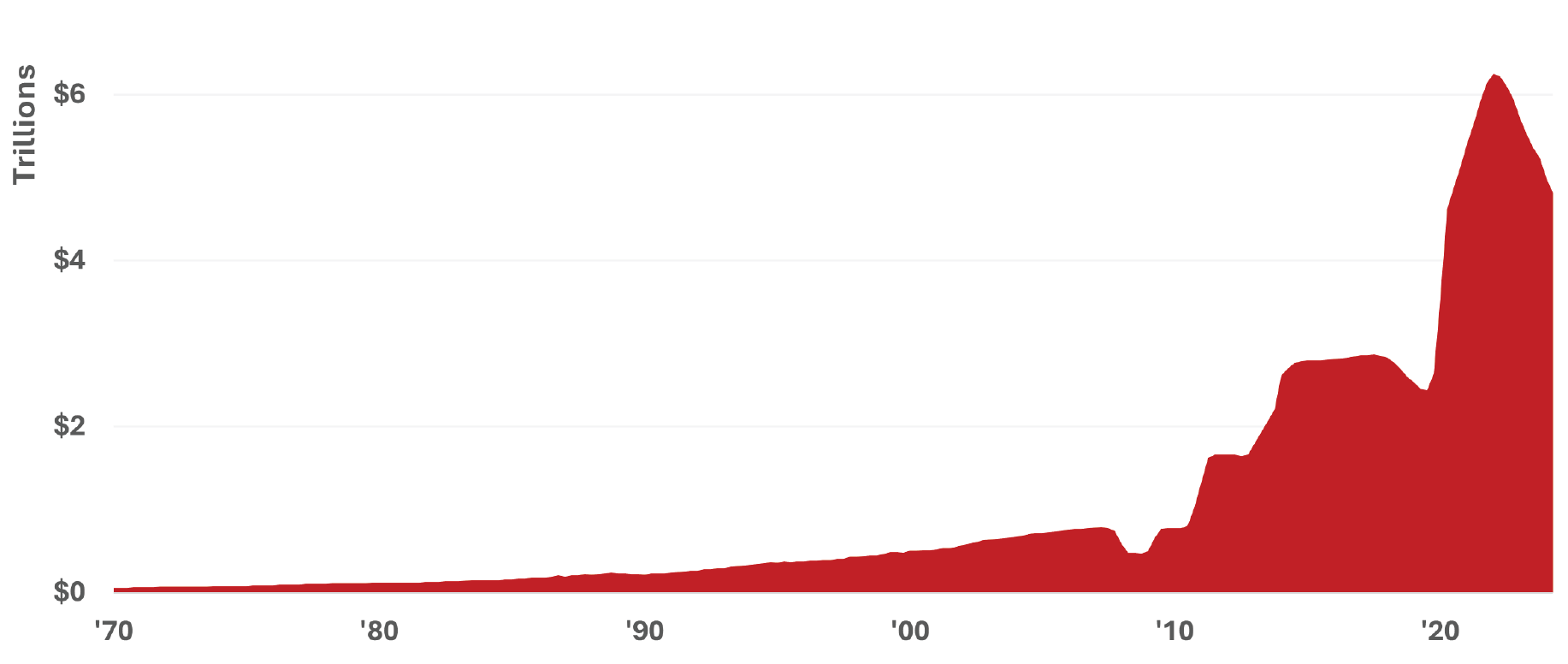

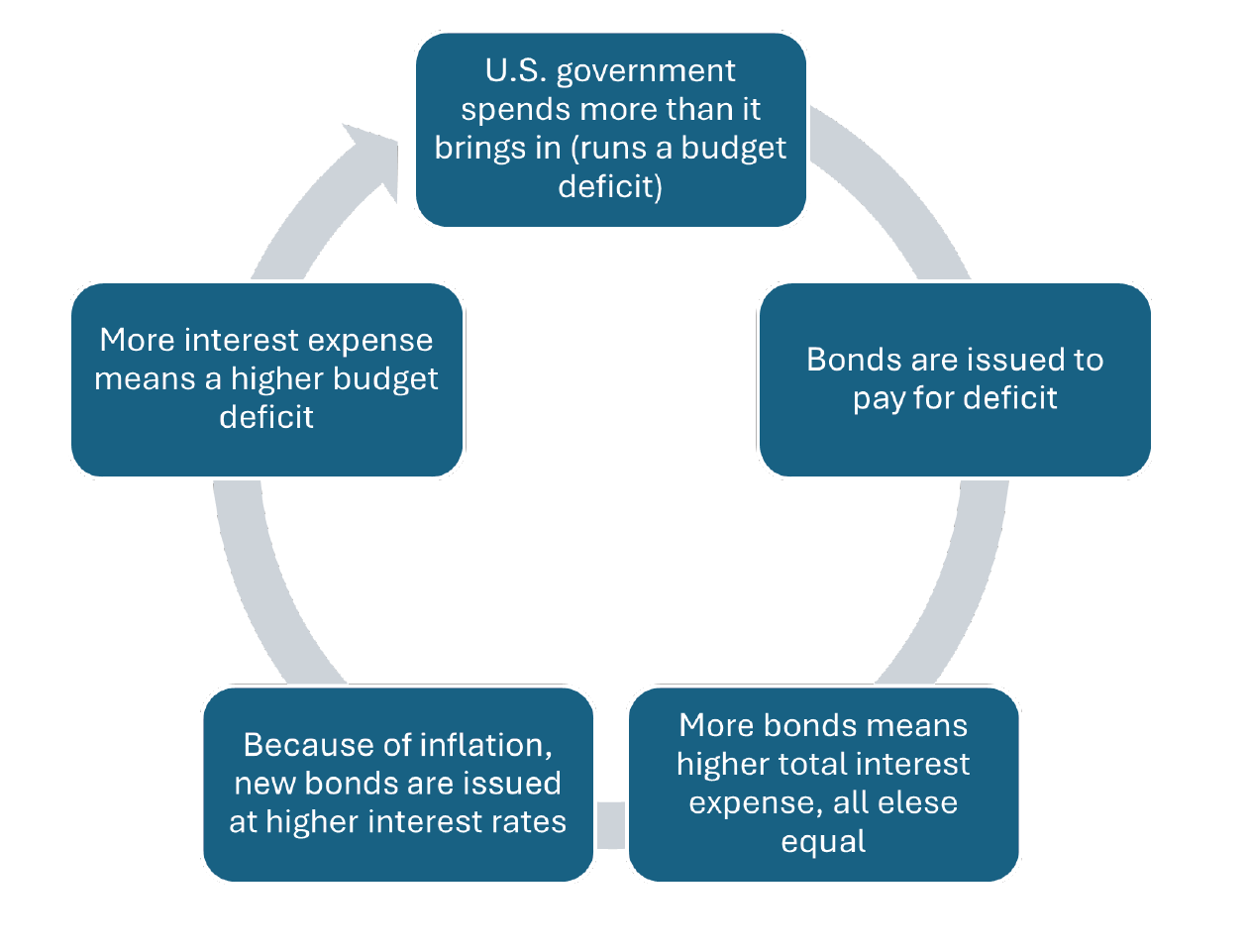

So how does the government continue to operate if it is consistently spending more than it brings in? It issues debt by selling Treasurys and other securities.

All else equal, growing amounts of debt will lead to higher interest expense payments. This is a problem because debt is becoming an increasingly large government outlay that, without changes to fiscal policy, will require more debt issuance simply to pay the interest expense.

5Department of Treasury. Debt held by the public. Based on quarterly data through April 2024.

6Congressional Budget Office. The Budget and Economic Outlook: 2024 to 2034. Published February 2024.

7U.S. Bureau of Economic Analysis. September 2024.

The next important player in this story is the Federal Reserve (the “Fed”). In its own words, “the Federal Reserve System has been given a dual mandate, pursuing the economic goals of maximum employment and price stability. It does this by using a variety of policy tools to manage financial conditions that encourage progress toward its dual mandate objectives—in other words, conducting monetary policy.”8

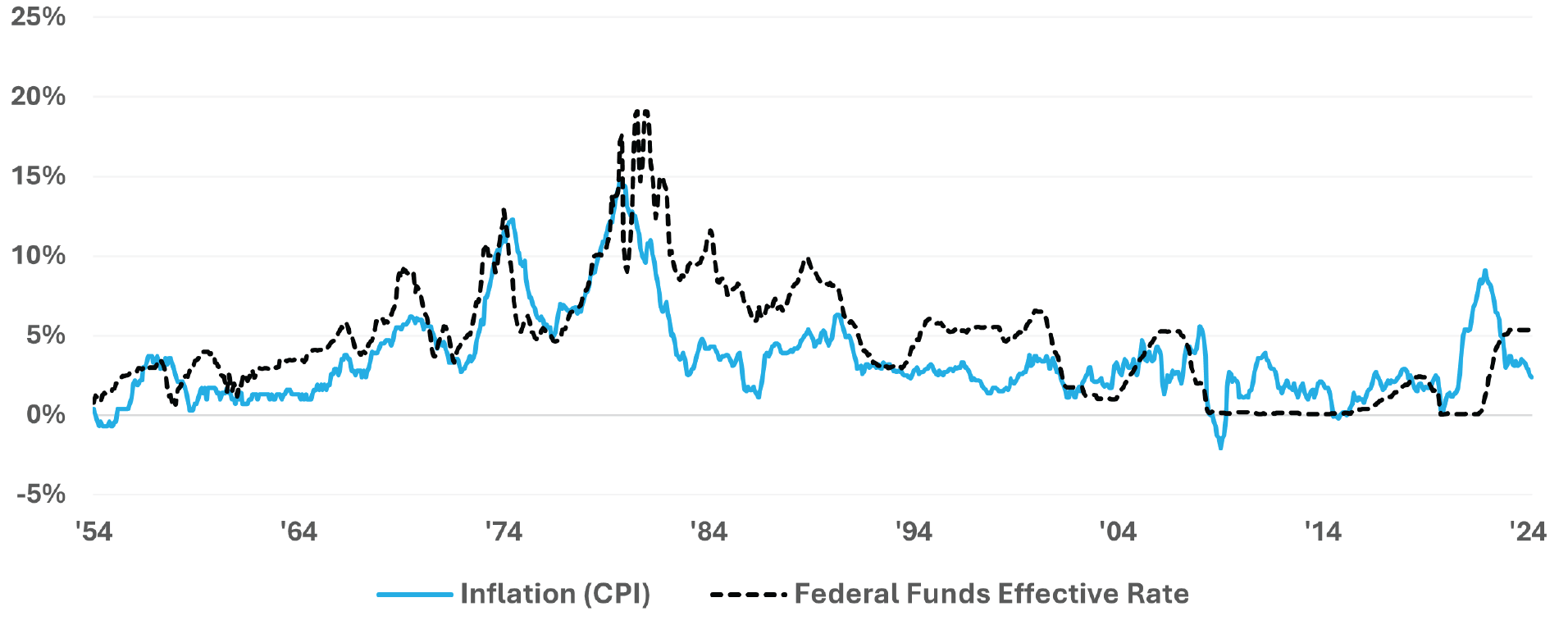

Following the great financial crisis in 2008, the Fed, through a process called Open Market Operations, brought interest rates to zero and implemented emergency spending programs. Initially, the goal was to stabilize the economy. However, it maintained rates near zero and continued spending programs despite a strong economy. The result: a significant increase in the money supply, inflation, and dollar debasement.

8St. Louis Federal Reserve Bank. The Fed and the Dual Mandate.

9Bloomberg LP. OECD. Federal Reserve Bank of New York. October 2024. The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

10U.S. Department of Treasury. September 2024.

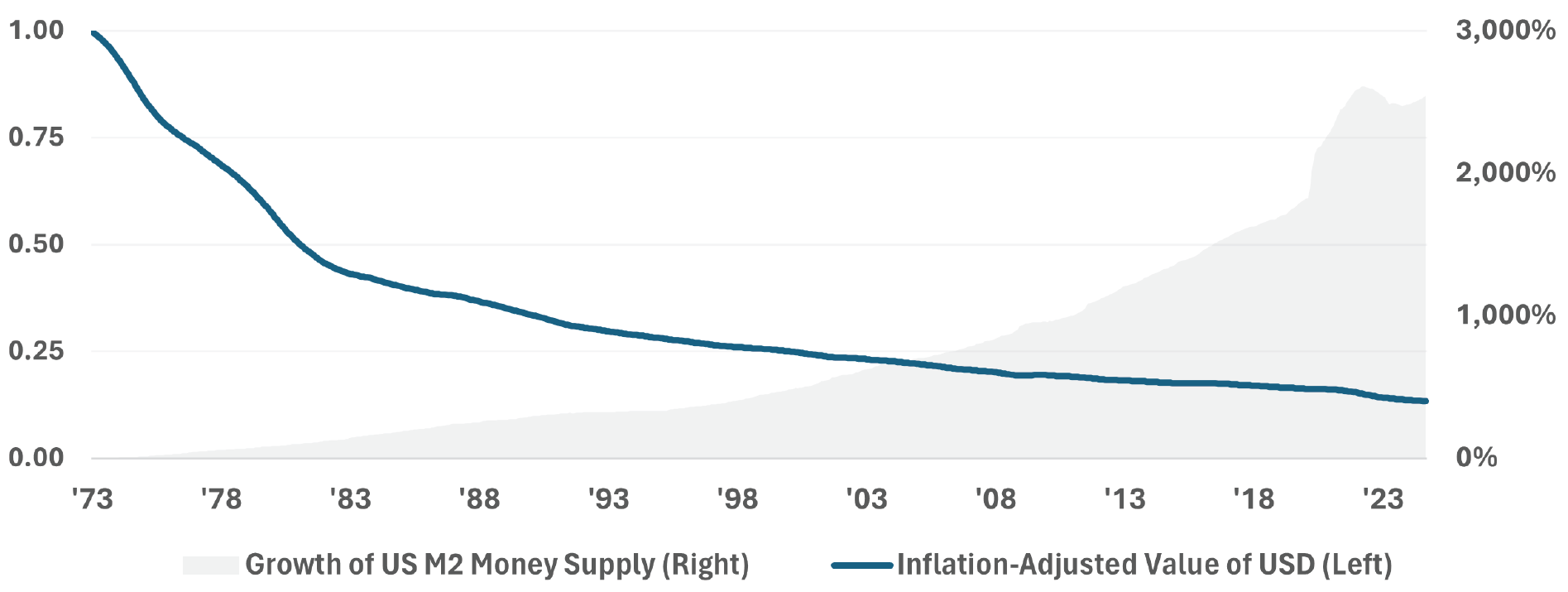

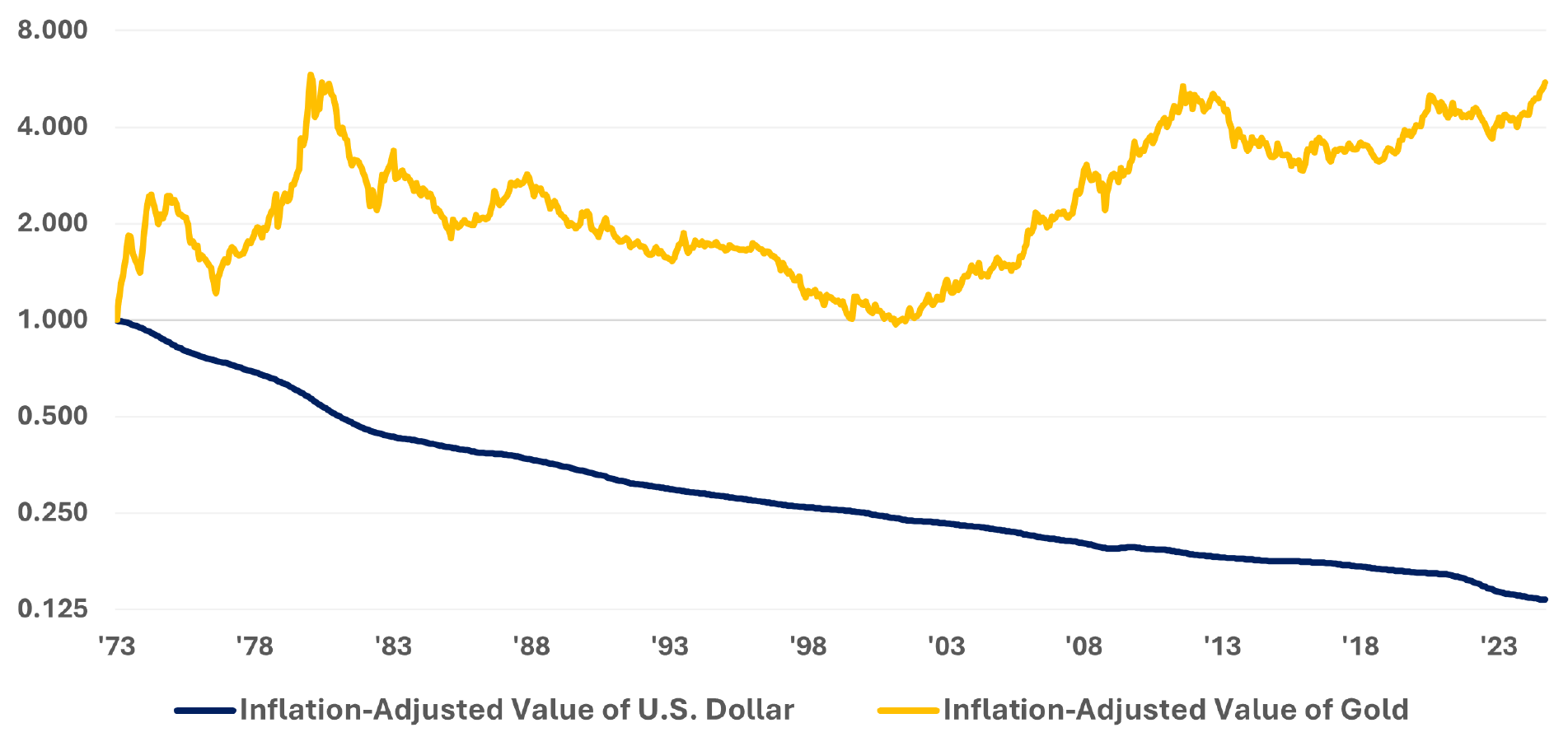

The M2 money supply is a measure of the total dollars in cash deposits and other deposits readily convertible to cash, such as money market funds. The Fed’s actions since 2008 significantly inflated the M2 money supply, growing it 159%. From 2020 to 2024, the M2 money supply grew by 38%. When all this money enters the financial system, the value of the dollar erodes in a process called dollar debasement. This is why a dollar today is worth only $0.13 of a dollar in 1973.

Another consequence is inflation. Following a 40-year high in inflation in 2022, the Federal Reserve was required to enter one of the steepest interest rate hiking cycles in history. Interest rates went from zero to over 5%. A consequence was that the new debt issued by the federal government was done at much higher interest rates.

11Bloomberg LP. Board of Governors of the Federal Reserve. OECD. September 2024.

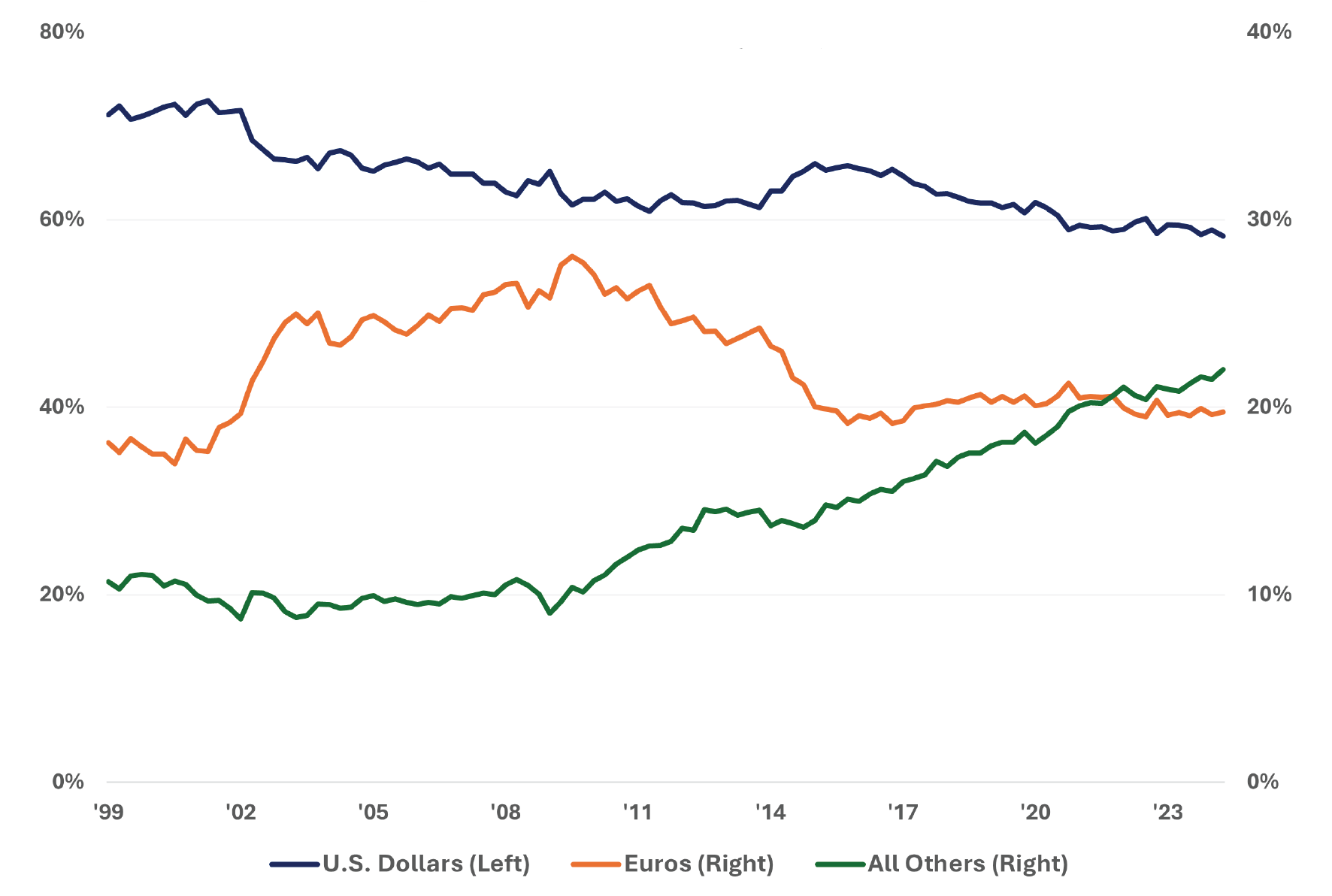

Thus far, the U.S. has survived the self-perpetuating debt cycle because of the dollar’s status as the world’s reserve currency. This status carried over from the Bretton Woods era post-1973 and was maintained because of the United States’ standing as an economic and military leader with political stability. Essentially, the U.S. dollar has been perceived as a safe and stable currency for which the

world can conduct trade and financial transactions. Yet, the U.S. dollar’s status as the world’s reserve currency continues to decline in a process known as de-dollarization. The most used benchmark of the U.S. dollar’s status, known as the percentage of total foreign exchange (“FX”) reserves, reveals that the dollar dropped from 71% of reserves in 1999 to just 58% in 2024.12

There are two themes underlying the decline in the U.S. dollar. The first is the decline in the perception of the stability of the U.S. dollar and the political system that backs it. The second is a natural movement to alternative systems which better facilitate trade and transactions. In this paper, we focus on the first.

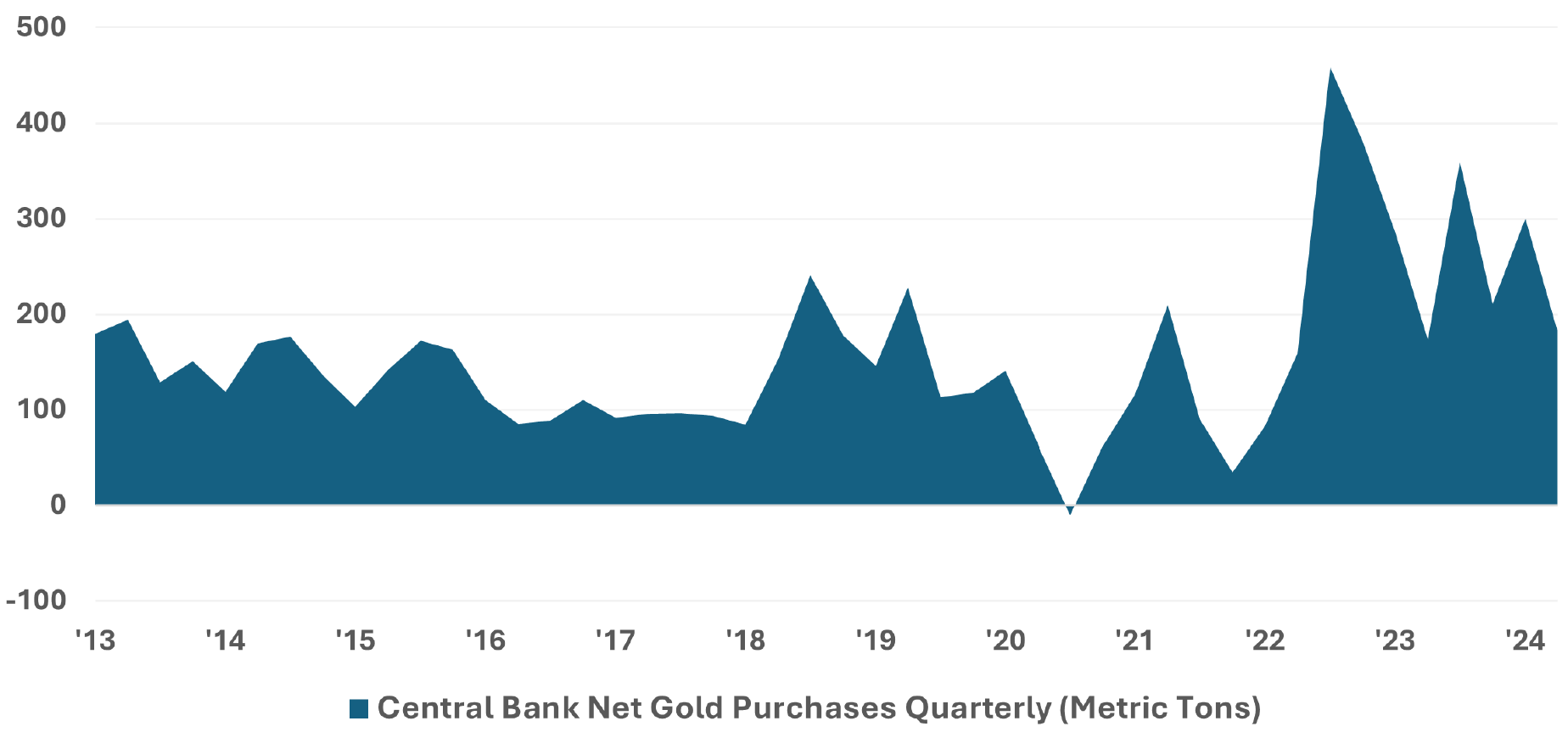

From a geopolitical perspective, the U.S. government has shown its willingness to weaponize the U.S. dollar. Following Russia’s invasion of Ukraine in 2022, the U.S. Department of Treasury’s Office of

Foreign Assets Control disconnected several Russian banks from the international financial system backed by SWIFT. These banks conducted approximately 80% of their $46 billion of foreign exchange transactions in U.S. dollars.14 Other adversaries of the United States have been threatened with the same. Despite a country’s relationship status with the United States, this type of action raises concerns about the viability of the U.S. dollar and has led many central banks to seek out alternatives, including gold.

12IMF COFER.

13Bloomberg LP. IMF COFER. September 2024.

14U.S. Department of Treasury Press Release. U.S. Treasury Announces Unprecedented & Expansive Sanctions Against Russia, Imposing Swift and Severe Economic Costs.

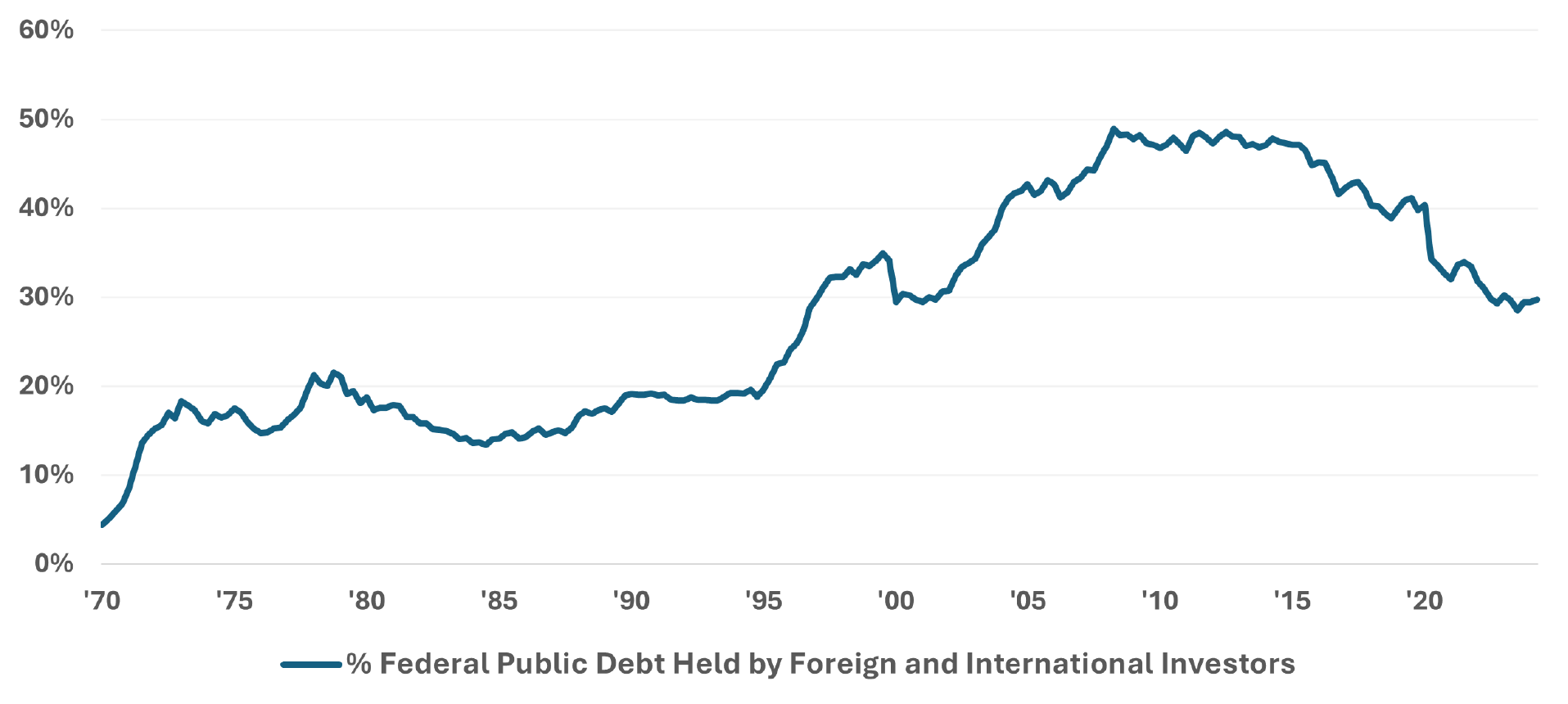

The growing debt problem in the United States raises a lot of concerns. It is uncertain how these levels of deficits and debt can be maintained, especially if inflation requires interest rates to go up. The world’s reserve currency status made U.S. federal debt and attractive option for foreign purchasers. Yet there is a growing trend where foreign

and international investors are becoming a smaller fraction of total public holders of U.S. federal debt. It should come as no surprise that dollar devaluation via money printing is the result, at least in the short-term where there are enough willing buyers of U.S. federal debt.

15Bloomberg LP. Quarterly demand (net purchase) data. June 2024.

16U.S. Department of Treasury. April 2024.

Gold has served as mankind’s most enduring form of money for millennia and has always played an important role in the international monetary system. It was the basis for the value of the U.S. dollar and foreign currencies prior to the end of the Bretton Woods System in 1973.

Gold’s unique attributes have well positioned it to play this role. Beyond its physical properties as a precious metal, scarcity is one of the most important attributes in terms of its enduring value.

Only 244,000 metric tons of gold have been discovered today, including 57,000 metric tons underground; a simple container 23 meters on each side could hold all the gold discovered thus far.17

Gold cannot be turned into a money printing machine. Unlike the U.S. dollar, gold is not backed by debt and has maintained its purchasing power during periods of inflation. Gold’s value is derived independent of the holder or counterparty, and it is not able to be manipulated for political purposes.

Even after adjusting for the impact of inflation, $1 worth of gold in 1973 is now worth over $5 while the value of $1 in 1973 is only worth $0.13 in 2024. In fact, except for a very brief period in 2001, the inflation-adjusted value of gold has always been higher than it was in 1973, demonstrating its resilience as a hedge against inflation.

Gold is at record highs and strong trends are already underway that should serve as tailwinds for

the price of gold. Without any meaningful change in U.S. fiscal policy, which seems unlikely as we sit here in 2024, the price of gold could continue to skyrocket. Investors have several choices when it comes to accessing gold. Investors can leverage their gold exposure to also generate a yield by combining a gold overlay with other income-producing strategies. This approach allows investors to access gold while putting their money to work in strategies that can regularly pay them now.

17U.S. Geological Survey. How much gold has been found in the world?

18Bloomberg LP. OECD. September 2024.

This communication is provided for informational purposes only. Rational Advisors, Inc., investment advisor to several Strategy Shares ETFs, offers financial products that may be discussed in this communication. Rational Advisors, Inc. has used resources that it believes to be reliable, including market and price data, to prepare this communication, but Rational Advisors, Inc. does not guarantee its completeness or accuracy. This communication is not intended as an offer or solicitation for purchase or sale of any financial product. This communication should not be construed as investment advice.

Investments involve risk including possible loss of principal.

The price of gold fluctuates over time. There is no guarantee that an investment in gold will increase or even maintain its value. Short-term, the price of gold has fluctuated widely. If gold markets continue to be characterized by wide fluctuations, the price may change in an unpredictable manner. Long-term, gold markets have historically experienced extended periods of flat or declining prices. There is no guarantee that the price of gold will move as expected relative to the U.S. dollar, nor is there any guarantee that gold will act as an effective inflation hedge.